Why move beyond bank deposito?

Keep your cash accessible while earning optimized returns with clear terms.

Same peace of mind you expect from deposits with fewer limitations.

Traditional bank deposits

Safe, but restrictive

20% tax cuts directly into your earnings

Early withdrawals come with penalties

Locked-in periods that restrict your access

What you get with us

Net returns from NAV growth — your gains reflect real portfolio performance

Flexible redemption with T+3 settlement for quick liquidity

Zero withdrawal penalties, anytime

Digital bank deposits

Strong short-term appeal, with ever-changing terms

Tiered minimum balances for top rates - many don’t qualify

Promo-based rates that can drop anytime

Unpredictable returns due to sudden rate changes

What you get with us

No tiers - start from Rp10.000 with equal returns via NAV

Steady growth without promos or limited-time offers

Professionally managed portfolio of money market and bonds for stable performance

For your every day life

Keep your cash accessible while earning optimized returns with clear terms.

Same peace of mind you expect from deposits with fewer limitations.

Planning for near-term goals

For anyone preparing for something meaningful in the near future like saving for a second home, starting a new venture, renovating a space, or funding a personal milestone. Smart Cash keeps your money growing while you get ready for what’s next.

Making the most of your extra income

Whether you just received a bonus, sold an asset, or have business income waiting to be used, Smart Cash helps your funds stay productive. Perfect for anyone who knows the money will be needed soon—but doesn’t want it sitting idle.

Seizing short-term opportunities

For investors who want to use today’s attractive money market and bond yields, Smart Cash portfolios give you a simple, low-risk way to benefit. Great for those looking to make the most of the current environment without committing long term.

Getting a taste of investing

Ideal for anyone who wants to start investing but prefers to begin with something low-risk. Smart Cash helps you optimize your idle cash, grow it steadily, and experience investing without taking big risks.

Choose the portfolio that fits your timeline

Four options to consider to match how soon you’ll need the money and your comfort with price movements.

Smart Cash Core

Low risk

For short term (<2 years)

Simpan Cash Fund

100%

100% money market fund. Grows your cash steadily through quality bank deposits and short-term government securities, low risk, high liquidity.

Suitable for

Suitable for funds that need high liquidity like your emergency fund or money you may need at any moment.

Returns (1Y)

4.44%

Max Drawdown

-0.01%

Benchmark

100% 3 Month Deposit Rate

Rp 1.000.000

Smart Cash Secure

Low risk

For short term (<2 years)

Simpan Cash Fund

70%

Simpan Bond Fund

30%

70% our money market fund, 30% our bond fund. Adds a boost from government bond yields while keeping risk low and stability high.

Suitable for

Cash you’ll use within a year like buying a new gadget, planning a trip, or alternatively making the most of extra income from bonuses or asset sales.

Returns (1Y)

6.07%

Max Drawdown

-0.31%

Benchmark

70% Simpan Cash Fund

30% Simpan Bond Fund

Minimum Investment

Rp 1.000.000

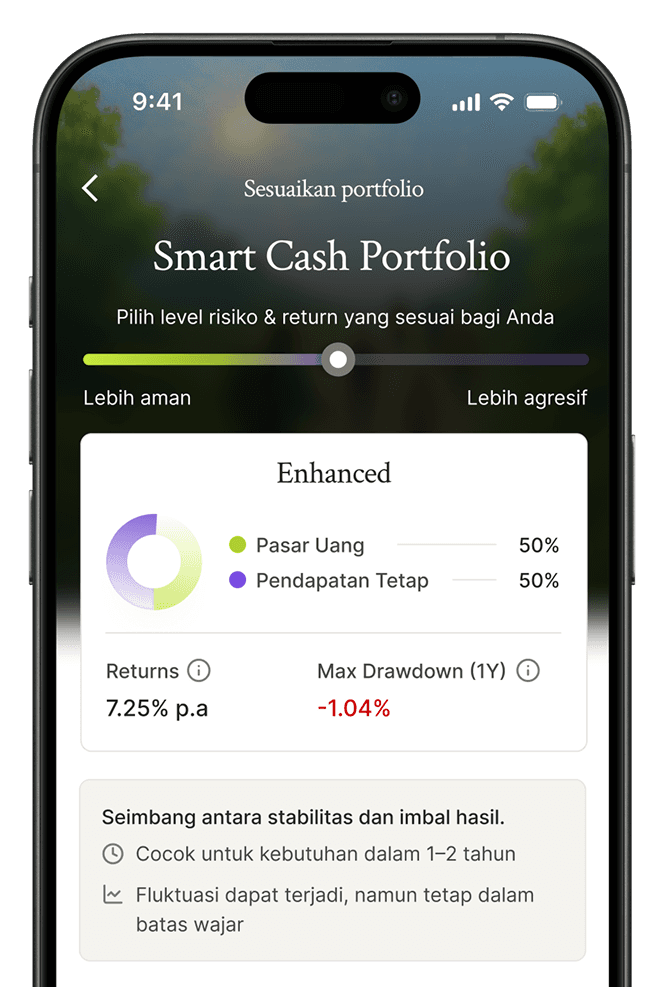

Smart Cash Enhanced

Low to moderate risk

For medium term (1-3 years)

Simpan Cash Fund

50%

Simpan Bond Fund

50%

50% our money market fund, 50% our bond fund. A balanced mix aiming for higher returns than Secure, with moderate, calculated risk.

Suitable for

Goals within 1–2 years such as saving for a second home, renovating a space or starting a new venture.

Returns (1Y)

7.07%

Max Drawdown

-0.62%

Benchmark

50% Simpan Cash Fund

50% Simpan Bond Fund

Minimum Investment

Rp 1.000.000

Smart Cash Progressive

Low to moderate risk

For medium term (1-3 years)

Simpan Bond Fund

100%

100% our bond fund. Targets the highest yields in the Smart Cash range by focusing on Indonesian government bonds.

Suitable for

Money you can set aside for 2+ years—ideal for planning a wedding, preparing a child’s school down payment, or other longer-term needs.

Returns (1Y)

4.68%

Max Drawdown

-0.01%

Benchmark

100% INDOBeX Total Return Index

Minimum Investment

Rp 1.000.000

WE'VE GOT YOU COVERED