With us, your investment is actively managed on two levels

Take advantage of equity upside without monitoring market daily

If you want growth from the stock market, but don’t have the time to monitor market 24/7 and make confident decisions.

Let us seize the best opportunities for you.

Keep your investments resilient, no matter the economic condition

AMP is designed to protect your investment from market shock and short-term market noise, so your money spends less time recovering from drawdowns.

Skip costly mistakes. Market is volatile, conflicting advices are noisy.

Timing errors are expensive. Our team translates market volatility into opportunities for you. You no longer have to second-guess your decisions.

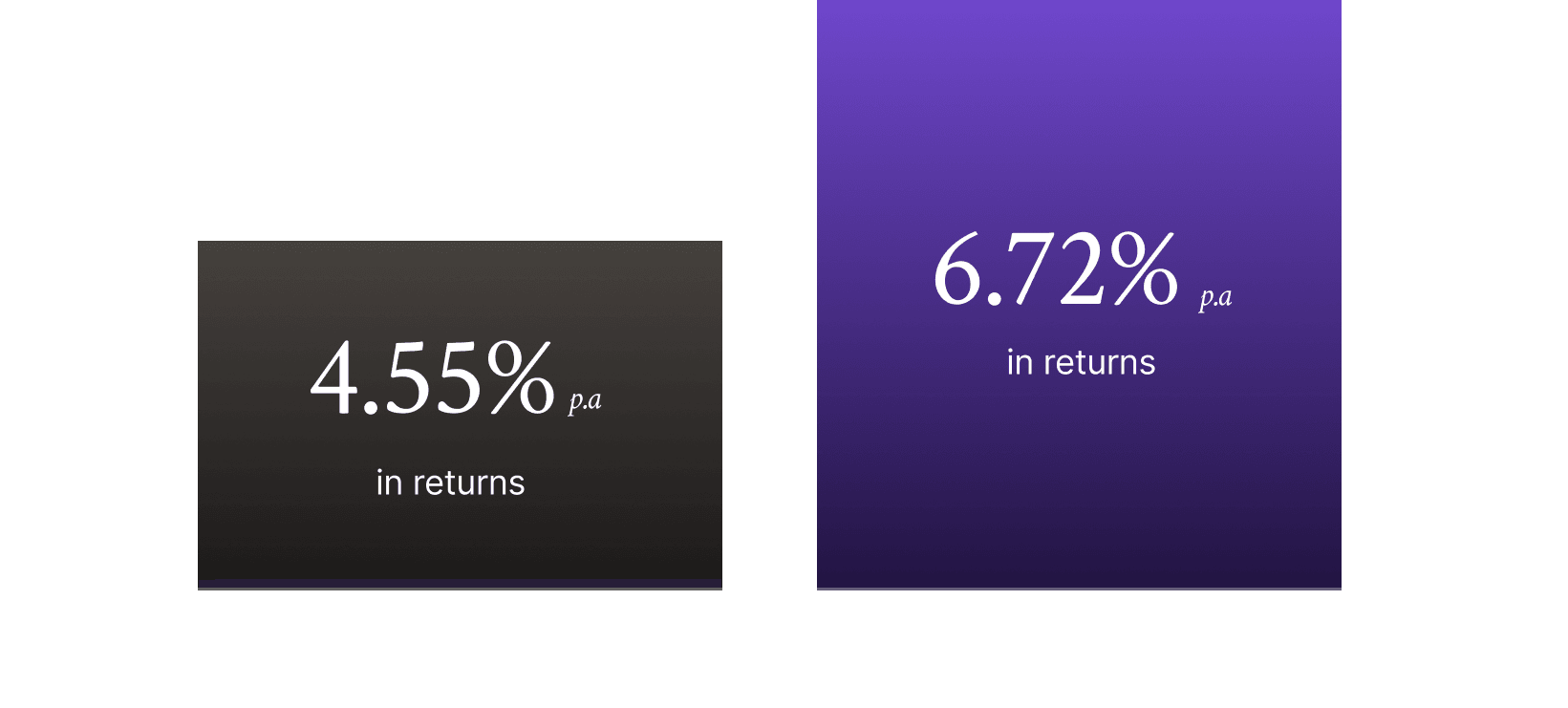

Simulation of our backtesting

If you start investing with IDR 100 mio in Jan 2015

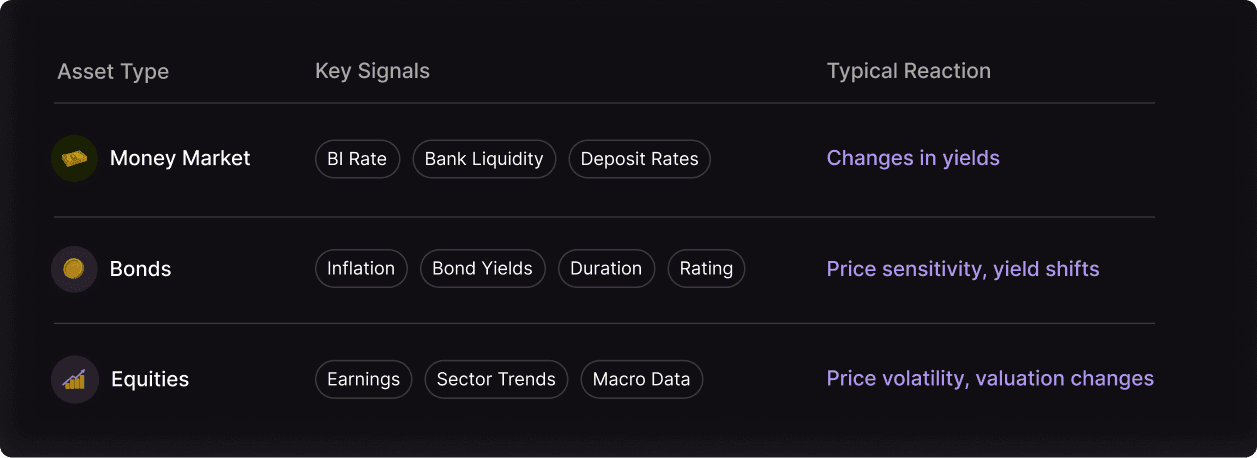

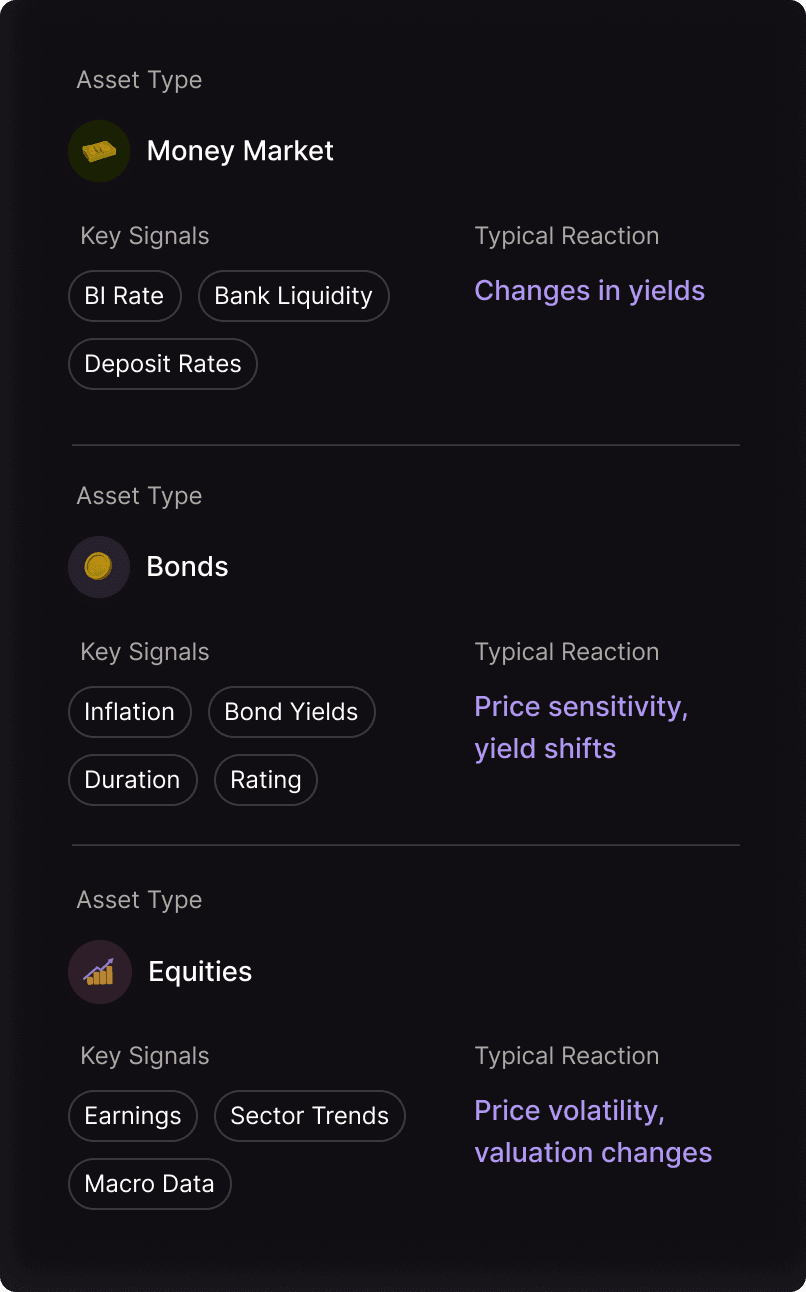

Keeping your portfolio healthy involves watching a wide range of signals. We handle the heavy lifting for you We monitor the metrics that matter across cash, bonds, and equities, then apply human insight to turn those signals into smarter portfolio decisions.

Actively Managed Portfolio falls less during stress periods

This example shows how much a static 25/25/50 portfolio could have dropped during the COVID-19 market downturn compared to an actively managed allocation.

Higher potential returns through smoother compounding

By reducing drawdowns, the portfolio recovers faster, resulting in potentially around 2% higher long-term returns compared to a static allocation

*) This is based on our backtesting results

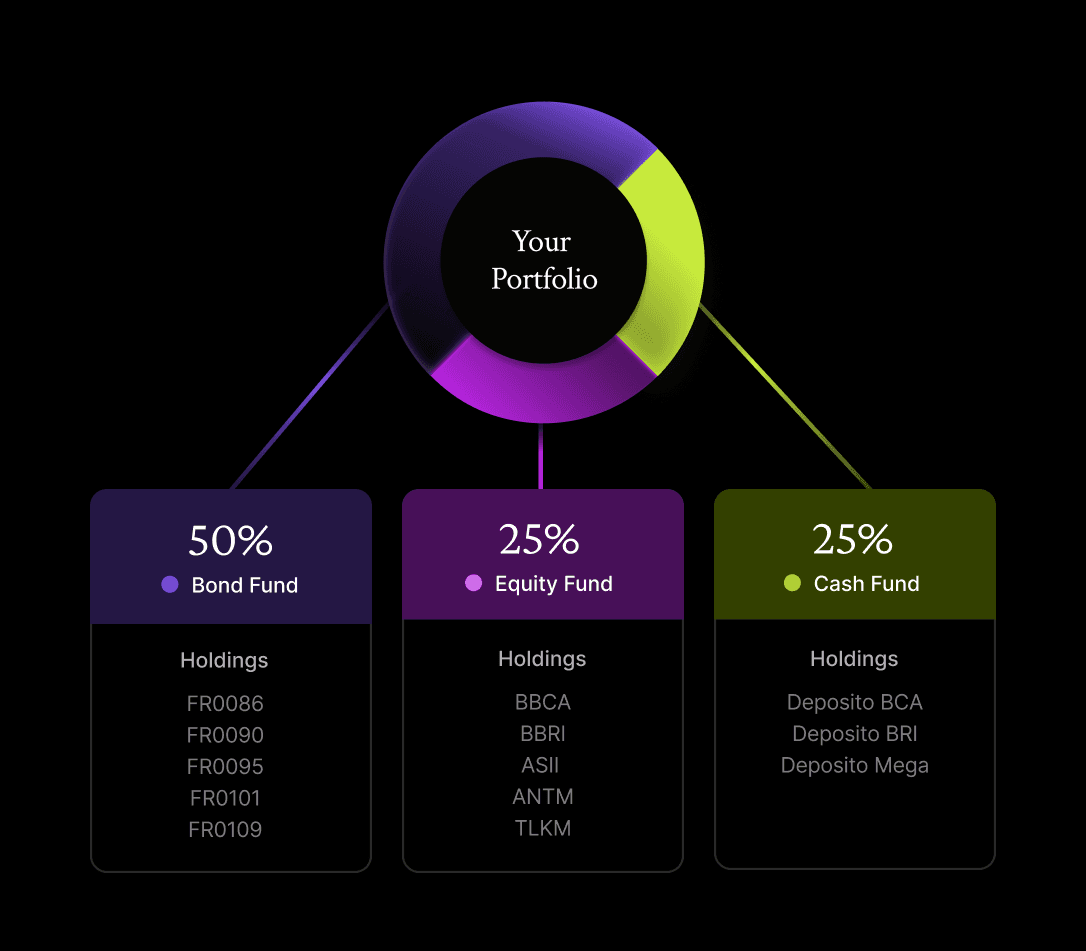

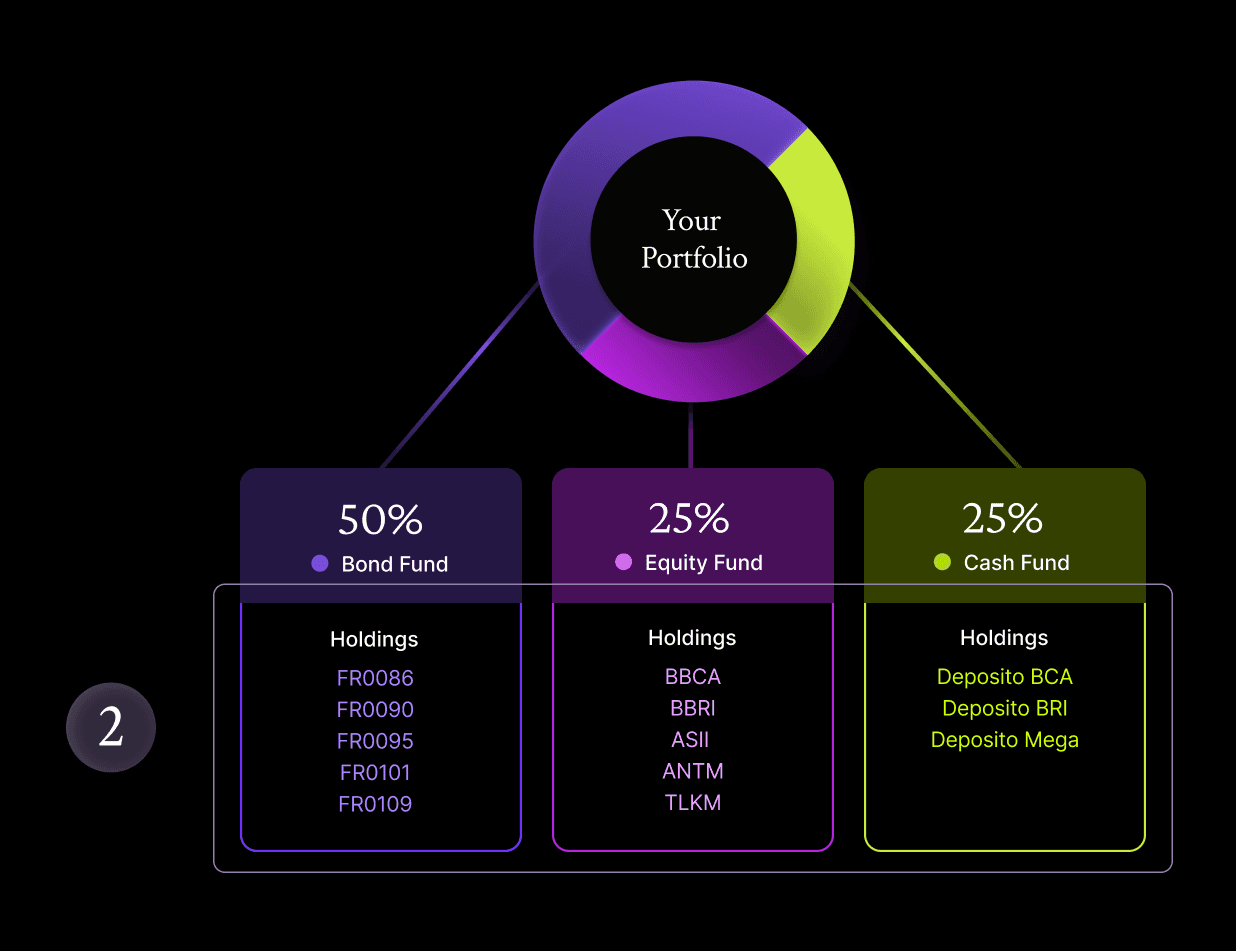

See how it works in our app

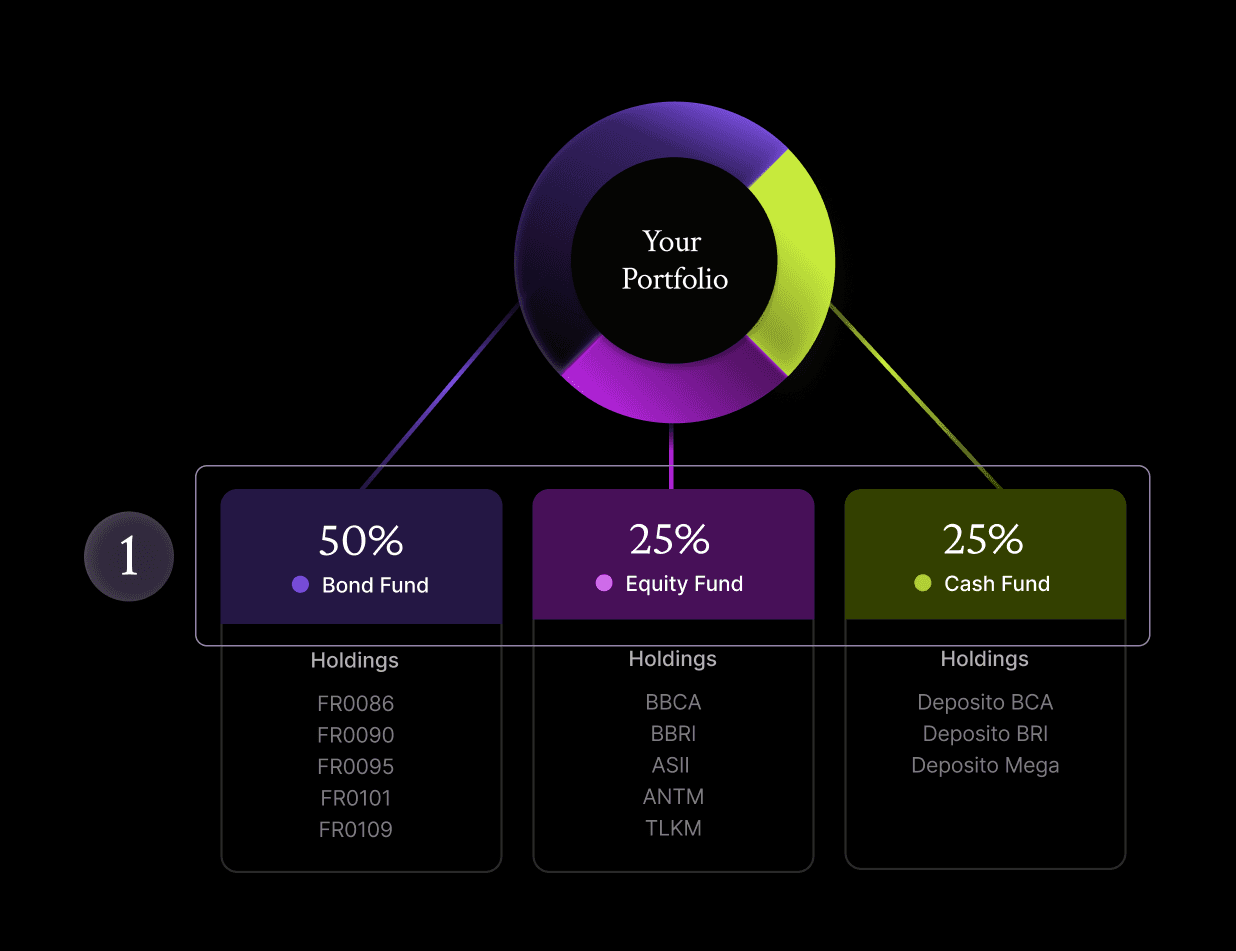

Pick a portfolio based on your risk comfort

We’ll monitor and rebalance your portfolio

Stay informed and guided on your portfolio

For you who prefers no exposure to equity fund, start with AMP Core

AMP Core

Low to moderate risk

For medium term (1-3 years)

Current Composition

40%

60%

Performance

as of 26 January 2026

Returns (1Y)

6.73%

Max Drawdown (1Y)

-0.48%

Benchmark

50% - Simpan Cash Fund

50% - Simpan Bond Fund

Fees

Management Fees

0.50% - 2.00%

Minimum Investment

Rp 5.000.000

AMP Focused

Moderate to high risk

For long term (>3 years)

Current Composition

44.25%

44.25%

11.5%

Performance

as of 26 January 2026

Returns (1Y)

8.69%

Max Drawdown (1Y)

-1.00%

Benchmark

43.75% - Simpan Cash Fund

43.75% - Simpan Bond Fund

12.5% - Simpan Sustainable Equity Fund

Fees

Management Fees

0.50% - 2.00%

Minimum Investment

Rp 5.000.000

AMP Enhanced

Moderate to high risk

For long term (>3 years)

Composition

38.5%

38.5%

23%

Performance

as of 26 January 2026

Returns (1Y)

10.69%

Max Drawdown

-1.81%

Benchmark

37.5% - Simpan Cash Fund

37.5% - Simpan Bond Fund

25% - Simpan Sustainable Equity Fund

Fees

Management Fees

0.50% - 2.00%

Minimum Investment

Rp 5.000.000

AMP Progressive

High risk

For long term (>3 years)

Composition

32.75%

32.75%

34.5%

Performance

as of 26 January 2026

Returns (1Y)

12.67%

Max Drawdown

-2.90%

Benchmark

31.25% - Simpan Cash Fund

31.25% - Simpan Bond Fund

37.5% - Simpan Sustainable Equity Fund

Fees

Management Fees

0.50% - 2.00%

Minimum Investment

Rp 5.000.000

AMP Ultra Growth

High risk

For long term (>3 years)

Composition

27%

27%

46%

Performance

as of 26 January 2026

Returns (1Y)

14.65%

Max Drawdown

-3.90%

Benchmark

25% - Simpan Cash Fund

25% - Simpan Bond Fund

50% - Simpan Sustainable Equity Fund

Fees

Management Fees

0.50% - 2.00%

Minimum Investment

Rp 5.000.000

WE'VE GOT YOU COVERED